Cost accounting involves summarizing and analyzing all the costs associated with the business activities. This practice also makes it easy to understanding the various costs associated with the business and how those costs impact the business and its profits. Learn more about cost accounting and why its needed in organisations.

What is Cost Accounting?

Management accounting is the presentation of financial information to management in a suitable format to enable them to control the business, to plan and make decisions. Management Accounting Activities include Costing, Planning & forecasting, Control over activities, Evaluation of alternative options.

One of the activities of management accounting is costing

Every organisation want to know how much is it costing them to produce their goods and/or services. Identification of the cost of a unit of product/service is used for: Decision-making, Control, Financial reporting, Planning

Costing is the process of ascertaining costs; it involves the classifying, recording, and appropriate allocation of expenditure for the determination of costs of products or services; the relation of these costs to sales value; and the ascertainment of profitability.

There are different types of cost and costing methods, which will be discussed further in the article.

Cost Accounting vs Financial accounting

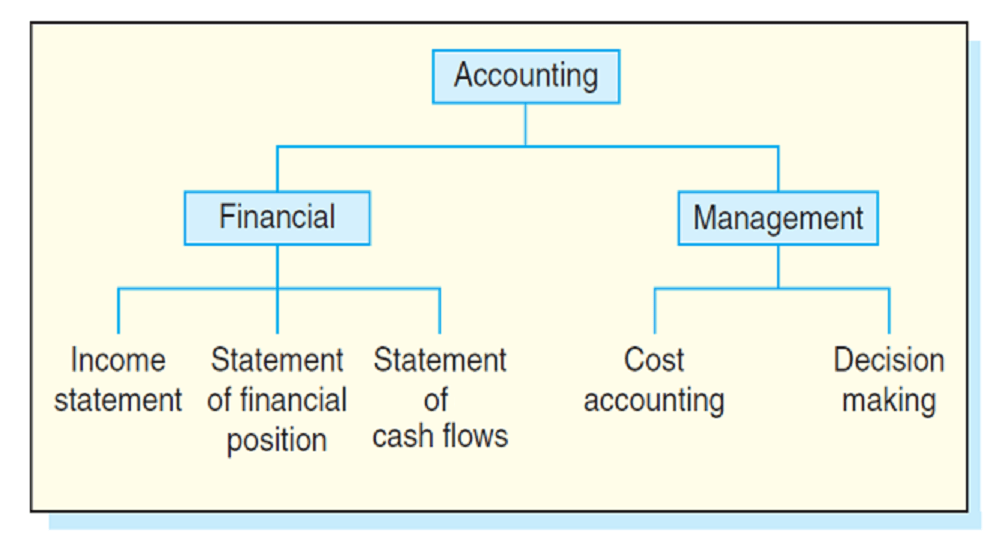

Cost accounting is inwardly focused, its used for management decisions. Financial accounting on the other hand is focused on issuing financial statements to outside parties.

The Institute of Cost and Management Accounting, London defines cost-accounting as “Cost accounting is the process of accounting from the point at which expenditure is incurred or committed to the establishment of its ultimate relationship with cost centers and cost units. In the widest usage, it embraces the preparation of statistical data, application of cost control methods and the ascertainment of profitability of activities carried out or planned”.

Costing uses certain techniques (principles) which are applied for ascertaining costs of products, jobs, processes and services. The ‘process’ refers to day-to-day routine of determining costs within the method of costing adopted by a business enterprise.

Costing Concepts

Cost Unit

A cost unit is the unit of output of an organisation, for which costs can be ascertained. Cost unit will depend on what a business makes, what is its output.

For example, a car manufacturer will want to know the cost of each car made. An accountancy firm will want to know how much costs have been incurred for each client and so will calculate the cost per hour of chargeable time spent by staff, so that they can readily work out the total value of time spent on each job.

Can you think of the appropriate cost units for the following industries?

- Manufacturing Brick-makers: Brewers, Frozen food processors, Computer manufacturer, Bakers, Paint manufacturer

- Service: Education, Hospitals, Solicitors, Insurance brokers

Classification of Costs

Classification of Costs is the logical grouping of similar costs, so that they can be totaled to give meaningful information.

The classification to be used depends on the purpose of the output information, and can be carried out in four ways:

- Element (material/labour/expense)

- Direct / indirect cost

- Function (who spends the money)

- Behaviour, i.e. fixed or variable

Cost Classification by Element

All items of expenditure are analysed as:- Material (raw materials, goods for re-sale),

- Labour (wages or salaries) or otherwise,

- Expense – anything not covered by the first two categories.

We can use this information to build up a “standard” or target cost for one item of production. This can then be compared to the actual cost of production to assess efficiency.

Classification by Direct or Indirect Costs

Direct costs are costs which are incurred for, and can be conveniently identified with, a particular cost unit.

- Direct materials – cost of materials which form a constituent part of the final product or service; including raw materials (e.g. steel to make a car), components (e.g. electronic components such as transistors in a TV) or finished products (e.g. paper used in book-making).

- Direct labour – cost of wages for working on a specific product or service (e.g. assembly time for TV or time spent by an accountant carrying out an audit).

- Direct expenses – other costs incurred for a specific product or service (e.g. hire of JCB equipment for a public works contract or sub-contracted finishing process).

The sum of direct materials, direct wages and direct expenses is known as prime cost.

Indirect costs are costs which cannot be associated with a particular unit of output, e.g. factory rent, depreciation on factory machine. These costs are required to operate the business.

The total of indirect materials, indirect wages and indirect expenses represents overheads.

Examples: Direct and indirect costs

- Direct Costs: Wood used to make chairs in a furniture factory, wages of carpenters who build chairs in the factory

- Indirect Costs: Factory rent, salary of factory manager, heat and light, general administration expenses

Cost Classification by function

Costs are identified by the function of the business responsible for incurring them. e.g. Production, Sales, Administration.

Cost Classification by Behaviour – Fixed or Variable

Variable costs are those which tend to vary in direct proportion to changes in the volume of output of the cost centre to which they relate, e.g. direct material costs (e.g. wood to make a chair), some indirect material costs (e.g. machine coolant)

Fixed costs are unaffected by the level of output, e.g. wages of foremen or storekeepers in a factory, premises costs (rent, rates, insurance), but also phone bills and heat and light expense – which may vary in amount, month by month, but are not solely/directly affected by the number of items made.

This classification is useful when preparing cost estimates or when making decisions.

Example: For a business that buys components and assembles them into finished computers, ready for sale, here are the fixed and variable costs.

- Variable: Circuit boards; solder to attach the components to the circuit boards;

- Fixed: servicing of air-conditioning and filtration system in Assembly area; costs of running Personnel department; telephone bill (mostly for administrative functions); wages of workers in Assembly department; salary of Production Manager; travelling expenses of sales reps; annual audit fee

Each of the classification methods listed above is useful for different purposes, for example:

- fixed or variable costs – can be used in break-even and contribution analysis

- function (which department spends the money) – will be needed when setting budgets, and using them to control the finances

- direct or indirect cost – to calculate the total cost of each item that we make, so that we can accurately value our stock and make pricing decisions.

Cost Centre

Cost centres are parts of the organisation for which costs may be ascertained. Cost centres may be departments, processes or a single machine or a person. Coding (i.e. writing a code on) a sales invoice or a purchase invoice is the means by which income and expenditure can be analysed to cost centres.

Once all costs have been put to cost centres, it is possible to determine the costs attributable to the cost units that have passed through each cost centre – this enables us to work out the cost per unit made.

Also, the cost centre managers are the people responsible for spending the money in their budget and they can be held accountable for any over-spend in their department – this is how cost control is achieved.

Total cost of cost unit = “absorption costing”

To ascertain the total cost of a cost unit, indirect costs are allotted to cost centres and cost centre costs are shared over (“absorbed by”) cost units.

Costing Methods

Different costing methods that businesses use to help them keep track of the cost of their products and services: Job Costing, Batch Costing, Process Costing, Contract Costing, Service Costing

Job costing:

Here, the cost unit consists of single order or contract, it is the work carried out to customer’s requirement.

- Usually high volume, low individual value

- Usually combined with absorption costing

- Shows profit/loss on each job; useful for estimating

Batch Costing:

This method is used when quantity of identical items are produced at the same time (in batches)

Here, a batch is treated as a job. The total batch cost is then divided by number of units.

Process costing:

Here, identical units of product are formed from a continuous series of production processes, e.g. chemical works, oil refineries, paint manufacturers.

- Usually get out less than put in = “normal loss”

- Can also have “abnormal loss or gain”

- Some year-end stock will be part-processed = WIP – use equivalent units, e.g. two units 50% complete = same cost as one complete unit

- Joint products and By-products may be seen

Contract costing:

This method is used when the cost units are large and last typically over 12 months, e.g. construction, civil engineering.

This method effectively separates profit and loss account for each contract

Service costing

This method is used where services are provided to an unidentifiable group of customers or common services to identifiable customers.

e.g. hotels, hospitals, transport operators, banks, insurance companies

The objective here is performance evaluation; costs are collected for each area of the business and activity measured.

Batch Costing – unit cost

This method is used when quantity of identical items are produced at the same time (in batches)

Batch treated as a job – total batch cost then divided by number of units

Pricing decisions

Pricing decisions are based on a number of business disciplines: Finance/ Accounting, Economics, Marketing. Here, we focus only on finance/accounting.

Major influences on pricing decisions: Costs, Customer demand, Actions of competitors; Political, legal, and image-related issues.

To make a profit, businesses must produce at a cost below the market price.

Prices are set by: Adding a mark-up to production costs, Market forces, Prices set by statutory authorities, A combination of these.

To determine price for Job Costing, identify material, labour and expenses directly associated with job. Add on a ‘chunk’ of overheads (called overhead “absorption” or “recovery”) and Calculate required profit element. This gives the final selling price.

Alternative Long-Run Pricing Approaches:

- Market-based Pricing: starts by asking about customers and competitors.

- Cost-based (cost-plus) Pricing: starts by asking about the company’s own cost of manufacturing the product.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website AcademicsHQ.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.