Mergers and Acquisitions

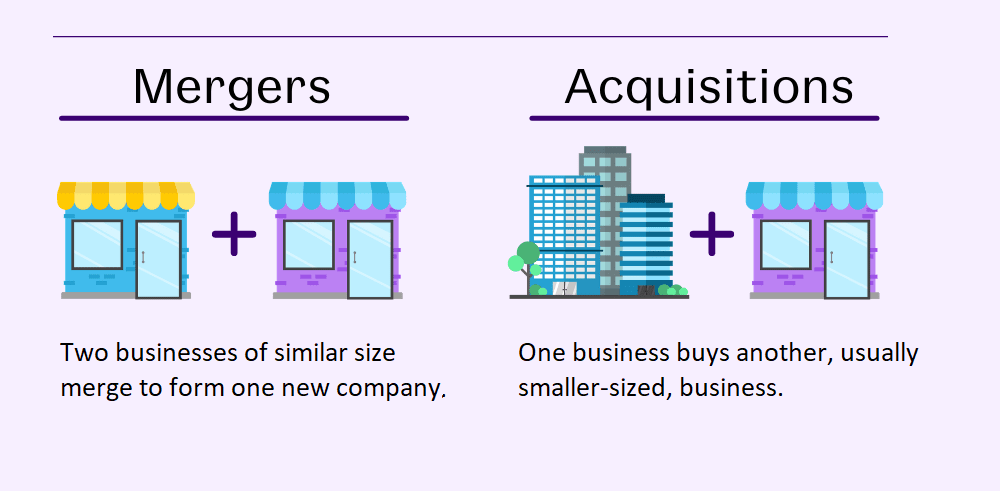

An acquisition is when you buy another business and end up controlling it. A merger is when you integrate your business with another and share control of the combined businesses with the other owner(s).

Mergers and Acquisitions are often treated together in the literature, legally they are transactions of a different kind.

An acquisition is an outright purchase of one company by another. It occurs when one company acquires enough of another company’s shares to gain control or ownership.

A merger is in theory a collaborative agreement by two companies to combine their interests, ownership and company structures into one company.

M&As are generally presented to shareholders as highly rational strategies with clearly defined goals and objectives. Typically these are of a financial or strategic nature.

- Financial goals include increasing shareholder wealth and financial synergy through economies of scale, transfer of knowledge and increased control.

- Strategic reasons include increasing market share, the reduction of uncertainty and the restoration of market confidence.

Mergers and acquisitions can also be sought by companies seeking to ward off hostile take-over bids.

Due to economic globalisation, cross-border mergers and acquisitions have emerged as the business growth area.

Actions that need to be carried out if M&A success is to be achieved:

1. Clarify the deal objectives and business case: The proposed deal price, expected implementation costs, value of inevitable losses as a result of the combination (e.g. staff), and the value of synergies, should all be made clear at the outset.

2. Monitor implementation against contribution to shareholder value: Effective progress in mergers requires an understanding of not just what tasks have been completed but also what benefits have been realised. Flexibility is also required, to accommodate change along the way.

3. Integrate quickly: A major contributor to risk in merger situations is uncertainty and the impact it can have on motivation and staff performance. This means that merging entities should quickly identify those activities and functions that are essential to the immediate bringing together of the companies and other improvement projects that can be undertaken subsequently.

4. Focus on retaining existing business: Mergers can cause a shift in focus from external to internal at the very time when the merging enterprises are under greatest scrutiny from both clients and investment consultants. As a result, opportunities to win new business are limited and the importance of retaining existing business may be underlined.

5. Focus on retaining key people: During a merger, senior management must also focus on retaining key staff, especially in sectors such as investment banking where the value of the business is heavily linked to key people. A significant proportion of the value of the deal could be lost if key individuals are lost early in the merger process.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website AcademicsHQ.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.