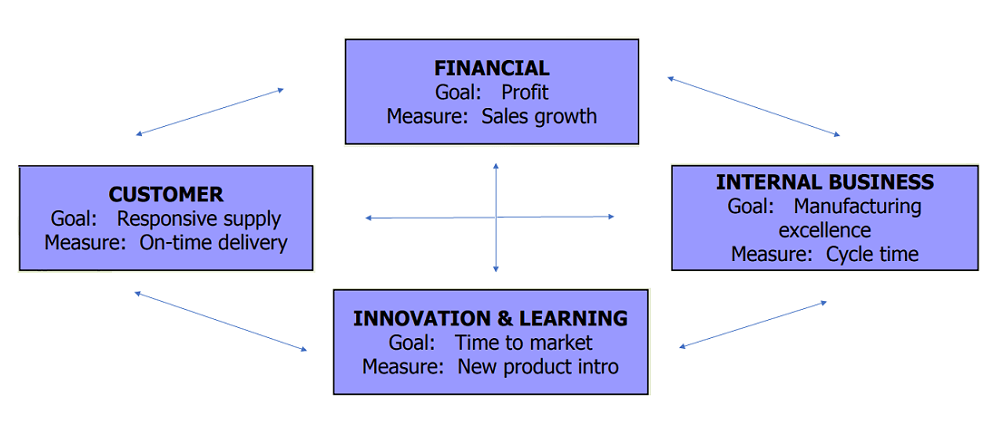

Balanced scorecard (BSC) is a strategic management performance metric that provides a comprehensive view of the business. In addition to finance measures, it also measures customer satisfaction, internal processes, and the innovation and improvement activities of the organization.

Challenges of Traditional Budgeting

Several executives felt for a long time that the traditional measures of financial performance were not enabling them to effectively manage things and felt that they needed operational as well for effective management.

Problems with accounting profit: Measured over a short time period, Ignores risk, Does not take full account of cost of capital invested, Can vary according to accounting policies chosen.

Traditional Budgeting and Performance Measurement Shortcomings:

- Reliance on accounting information and variance from this.

- Use of subjective assumptions in financial data

- Absence of potentially relevant external data

- Absence of non-financial data

Strategic management accounting overcomes some of these shortcomings. To support the strategic planning process, management accounting must become more concerned with:

- The external environment

- Developing methods to help outperform competitors

- Monitoring and successfully implementing business strategies

Balanced scorecard (BSC)

Arguing that executives should track both financial and operational metrics, The Balance Scorecard is a measure that lets executives do that as it incorporates four sets of parameters (Kaplan and Norton, 2001).

Kaplan & Norton introduced the Balanced Scorecard to reinforce the importance of considering other business performance measures alongside financial ones.

BSC aims to reduce short-termism of the 1980s when the focus was purely on financial measures. BSC is now widely adopted by many of the world’s largest companies, but is often adjusted.

Advantages of balanced scorecard to a firm:

- Over the years, Balanced Scorecard has become more popular with businesses using it as a framework for building strategy. Being able to fir the strategy in one-page allows a firm to easily communicate its strategy internally as well as externally.

- It enables managers to view performance of several areas (seemingly disparate elements) using one tool.

- It lets managers see if improvements in any specific business areas have been achieved at the expense of some other areas.

- Projects and Initiatives are better aligned with strategic goals. Having the Balanced Scorecard established enables firms to align their projects and initiatives in such a way that they deliver on the more strategic objectives.

Using BSC, firms are able to come up with key performance indicators that are aligned with the various strategic objectives. As a result, the firm measures things that matter which eventually helps improve their performance.

It can be customized to fit the needs of an organization.

Benefits of Balanced Scorecard

- Flexibility (fits to organisation and over-time)

- Links long term strategy directly to performance measurement.(discuss examples)

- Can be used to both measure performance of divisions and drive strategic change through KPIs linked to bonus/compensation.

Potential problems with the BSC

Some studies however have stated the limitations of BSC as well. It says that because BSC makes a firm focus most of its resources to achieve its goals, it may lead to underutilization of potential in areas not covered within BSC; and may hamper inter-organizational innovation (Emad and Amir, 2015); it may also lead to overtly focus on metrics (HBR, 2019).

- Requires significant investment of senior management’s time.

- Potentially measuring the wrong things, or mixing up cause and effect.

- KPIs can conflict and cause confusion.

- No clear prioritisation of KPIs can lead to a revision to financial KPIs in a recession.

References

Ardalan, K., 2017. Capital structure theory: Reconsidered. Research in International Business and Finance, 39, pp.696-710.

Atrill, P. and Mclaney, E.J. (2021). Management accounting for decision makers. Harlow, England ; New York: Pearson.

Atrill, P. and McLaney, E.J. (2020). Financial Management for Decision makers. 9th Ed. Pearson

Dyson, J.R. and Franklin, E. (2020). Accounting for non-accounting students. 10th ed. Hoboken: Pearson.

Emad, A and Amir, A (2015). A Critique of the Balanced Scorecard as a Performance Measurement Tool. International Journal of Business and Social Science. 6. pp 91

HBR (2019). Don’t Let Metrics Undermine Your Business. [online] Harvard Business Review. Available at: https://hbr.org/2019/09/dont-let-metrics-undermine-your-business.

Kaplan, R.S. and Norton, D.P. (2001). Transforming the Balanced Scorecard from Performance Measurement to Strategic Management: Part I. Accounting Horizons, 15(1), pp.87–104.

BATheories.com is managed by a group of educators from Mumbai. We also manage the website AcademicsHQ.com. Our panel includes experienced professionals and lecturers with a background in management. BATheories is where we talk about the various business theories and models for BA (Business Administration) students.